Unlocking Success Through Business Bookkeeping

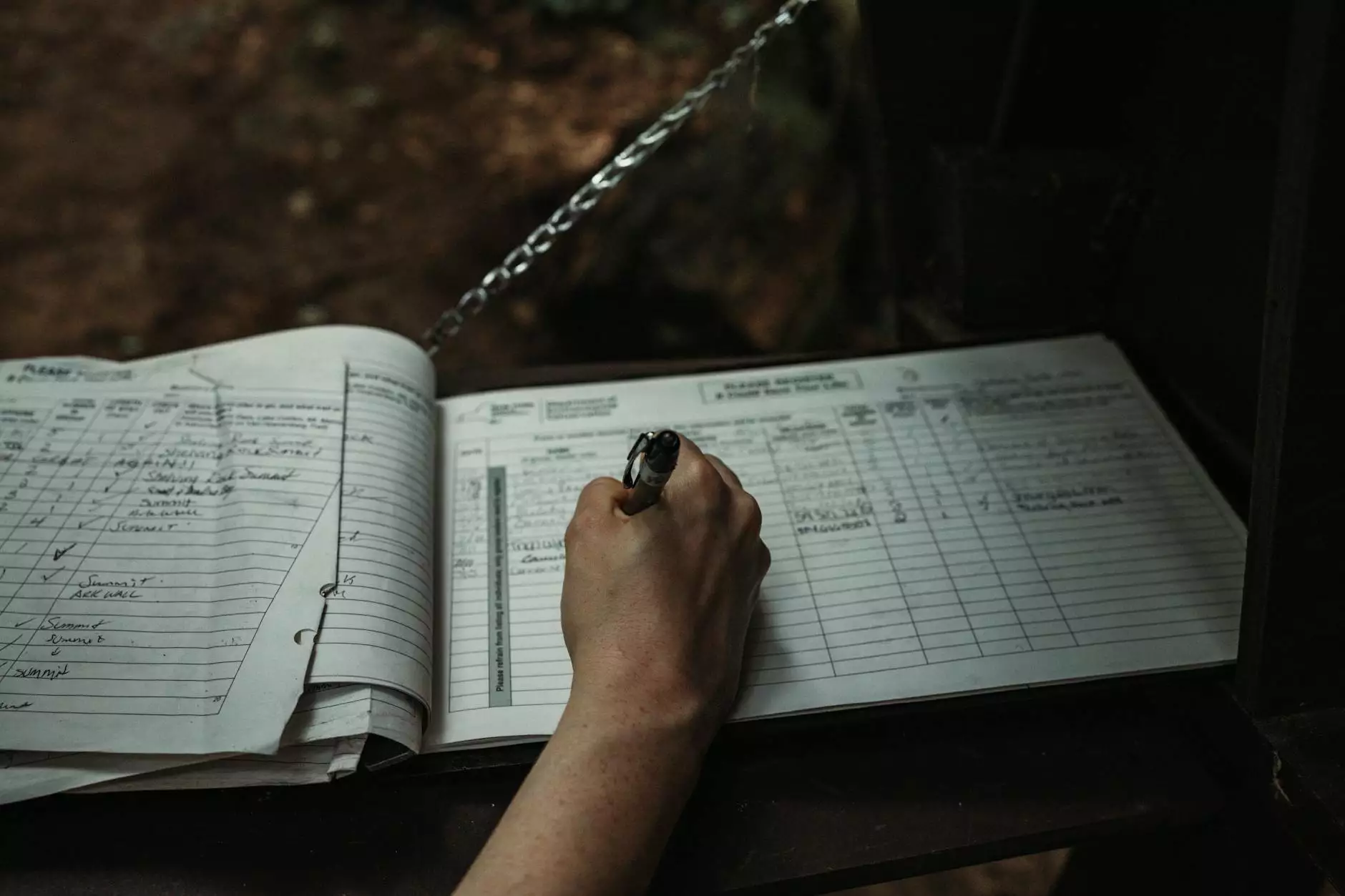

What is Business Bookkeeping?

Business bookkeeping is the systematic recording and organizing of financial transactions in a business. This fundamental practice forms the backbone of a company’s financial health and aids in making informed decisions for the future. Bookkeeping is not just about maintaining records; it encompasses various practices aimed at delivering crucial insights about your business’s financial situation.

Why is Business Bookkeeping Crucial?

The importance of business bookkeeping cannot be overstated. Here are several reasons why effective bookkeeping is vital for your business:

- Financial Clarity: Accurate bookkeeping provides a clear picture of your business’s financial health. It allows you to track income, expenses, and profits effectively.

- Regulatory Compliance: Businesses are required by law to maintain financial records for taxation and regulatory purposes. Proper bookkeeping ensures you meet these requirements.

- Informed Decision Making: With well-maintained financial records, business owners can make data-driven decisions, forecast future performance, and allocate resources efficiently.

- Cash Flow Management: Bookkeeping helps monitor cash flow, ensuring that your business has enough liquidity to meet operational needs and avoid financial pitfalls.

- Budgeting and Planning: Detailed records assist in creating realistic budgets, setting financial goals, and developing strategic plans for growth.

- Facilitates Tax Preparation: Well-kept financial records simplify the tax filing process, ensuring you maximize deductions and comply with tax regulations.

The Core Components of Business Bookkeeping

Successful business bookkeeping involves several core components that help streamline the financial management process. Understanding these components can enhance your bookkeeping practices:

1. Recording Transactions

Every financial transaction should be recorded meticulously. This includes sales, purchases, receipts, and payments. Use accounting software to automate this process for accuracy and efficiency.

2. Chart of Accounts

A chart of accounts categorizes all financial transactions for your business. It consists of various account types, such as assets, liabilities, income, and expenses, providing a structured framework for reporting and analysis.

3. Financial Statements

Regularly generating financial statements such as the balance sheet, income statement, and cash flow statement is essential. These documents summarize your business’s financial activity over specific periods and are critical for stakeholders.

4. Reconciling Bank Statements

Regular reconciliation of bank statements ensures that your bookkeeping records match your bank statements. This process helps identify discrepancies and prevents potential fraud.

5. Payroll Management

Managing payroll correctly is essential to ensure your employees are paid accurately and on time. This includes tracking hours worked, bonus payments, and withholding taxes.

6. Maintaining Backup Records

Backing up financial data is a best practice that protects your business from data loss. Cloud services and external hard drives can serve as backup solutions.

Choosing the Right Bookkeeping Method

There are two primary methods of bookkeeping: single-entry and double-entry.

Single-Entry Bookkeeping

This is a simple method suitable for small businesses. It records each transaction only once, tracking cash inflow and outflow. While easier, it lacks detailed financial analysis capabilities.

Double-Entry Bookkeeping

This method records each transaction twice—in at least two accounts. It provides greater accuracy and insights into your financial data, making it the preferred choice for larger organizations.

Utilizing Technology in Business Bookkeeping

In today’s digital age, leveraging technology can significantly enhance your bookkeeping processes. Here are some tech tools you can use:

- Accounting Software: Software like QuickBooks, Xero, or FreshBooks streamlines bookkeeping tasks, automating processes and generating reports.

- Cloud Storage: Services like Google Drive or Dropbox are essential for storing financial documents securely and ensuring easy access.

- Invoicing Tools: Tools that automate invoice creation and follow-up can save time and improve cash flow.

- Expense Tracking Apps: Mobile apps can help track expenses on the go, ensuring that no expense goes unrecorded.

How to Organize Your Bookkeeping System

An organized bookkeeping system is essential for efficiency. Here are some tips to maintain an organized environment:

1. Set a Schedule

Regularly dedicating time for bookkeeping tasks—weekly, monthly, and quarterly—ensures nothing falls through the cracks.

2. Categorize Transactions

Organizing transactions by category (like income, expenses, assets) simplifies reporting and performance tracking.

3. Keep Receipts and Documentation

Retain receipts and any relevant documentation for transactions. Digital copies are convenient for backup purposes.

4. Regular Reviews

Conduct monthly reviews of your bookkeeping records to identify patterns and adjust strategies accordingly.

Common Bookkeeping Mistakes to Avoid

Even experienced business owners can fall prey to common bookkeeping errors. Here are some mistakes to watch out for:

- Neglecting Transaction Records: Failing to record transactions promptly can lead to inaccurate financial statements.

- Lack of Reconciliation: Not reconciling accounts regularly can result in undetected errors or fraud.

- Mixing Personal and Business Finances: Maintaining separate accounts for personal and business finances is essential to avoid complications.

- Ignoring Financial Statements: Not reviewing financial statements regularly can result in missed opportunities for growth and improvement.

Benefits of Seeking Professional Bookkeeping Services

While some business owners manage their bookkeeping independently, seeking professional help can provide significant advantages:

1. Expertise and Experience

Professional bookkeepers have the requisite knowledge and experience to handle complex financial situations and reporting standards.

2. Time Savings

Outsourcing bookkeeping allows you to focus on core business activities, enhancing productivity.

3. Access to Advanced Tools

Professional accountants have access to advanced accounting software and tools that help streamline processes.

4. Personalized Financial Advice

Experienced bookkeepers can offer tailored advice and strategies to improve financial performance and efficiency.

Conclusion: Elevate Your Business with Effective Bookkeeping

In conclusion, mastering business bookkeeping is not just about maintaining records—it's a strategic tool for enhancing your business’s financial health. By understanding its significance, employing best practices, and possibly engaging professional services, you can drive your business toward success.

At BooksLa, we offer comprehensive financial services tailored to your needs. Our expert team is here to assist with your bookkeeping, so you can focus on what truly matters—growing your business.